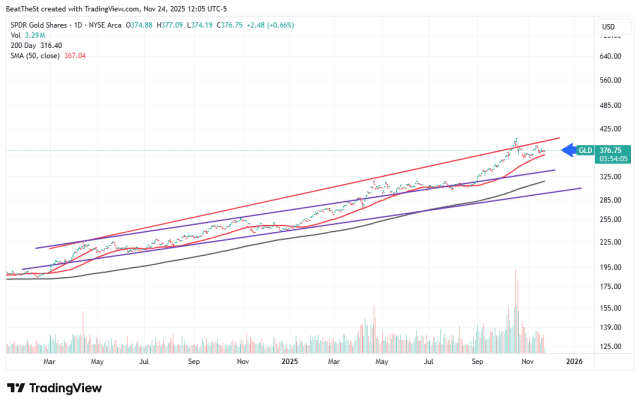

Market Timing Brief for November 24th, 2025:

I wrote what follows this discussion on October 10, 2025, but didn’t publish it. It turns out I was just 6 days early on the last gold top on October 20, 2025. The Fed prediction was also correct. Gold is now in a consolidation, and I rate GLD as a “Consolidating Uptrend™.” Read the tab above on my market timing trend classification system if you don’t know what that means and how to trade or invest when it has that trend status.

I have taken gold profits out previously, including 100% of my initial investment in 2011, and more recently adjusting my trading position down to 80% of usual maximum exposure to gold for a Bull market.

I express my exposure in those terms, so you can adjust yours to taste. If you normally have 5% gold no matter what and increase it to 10% during a Gold Bull Market, you would have dropped your exposure form 100% exposure to 80% for example, although it’s back up to 94% with the inclusion of gains, SLV, and GDX.

If gold breaks its trend per my definition, you may see me trim back toward and then to 50% of usual maximum exposure for a Bull Market in which case, in this example you’d go down to 5% which you hold “no matter what,” as a hedge against currency. Or you don’t. That’s up to you!

Here is the current chart:

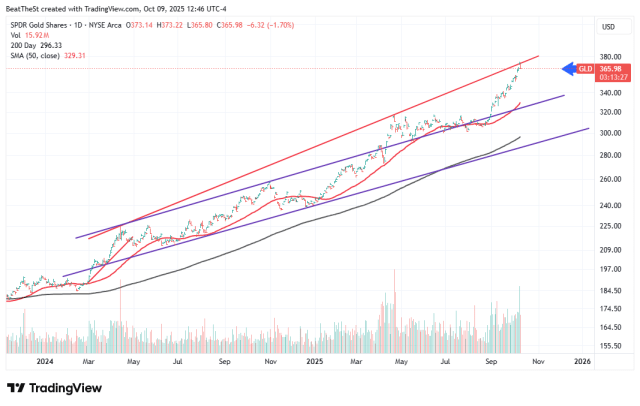

The following is what I wrote back on October 1o, 2025. Note the caption that says, “Is GLD starting a correction?” It was…

“An Update on the Gold Market”

Here is what I saw this past Thursday (Oct. 9, 2025)…

Here is some more history, which shows you how much I got right and how much changed, plus where rates are headed now. My updates are in brackets and in blue…

The following was written prior to the July 30, 2025 Fed Meeting outcome…

Trump gave away the punch line following his Fed building tour with Chair #Powell on July 24, 2025. He said they were in agreement on rates in so many words. He said that to hint that Powell had agreed to cut rates “soon” IMO. Otherwise, what was the point of lowering his antagonism toward Powell. The beating would have continued. It didn’t with the exception of the cost overruns on the Fed building project.

That means there are two possible outcomes to consider for tomorrow (July 30, 2025)…

1. The Fed cut rates tomorrow by 0.25% and surprises a market that expects NO rate cut at a 96.9% likelihood or…

2. The Fed will indicate in some indirect way that a Sept. cut is “very possible” to “likely,” but not using those words, as the Fed prefers to be more obtuse.

What They Will Do: Because the Fed does not like to surprise the market, it won’t cut rates tomorrow, but will signal a Sept. cut as in #2.

[11-24-25 NOTE: That’s exactly what happened. The Fed cut 0.25% in both Sept. and again in Oct.]

As a result, bonds and stocks will both rally further after the meeting. The bond impact will be greater at the short end of duration, so the 10-2 year spread will steepen. [11-24-25 NOTE: TLT peaked on 10-21-25 and retopped on 10-28-25 and has fallen since, although it’s been consolidating since the end of October. 10 Year Treasury Yield minus the 2 Year Yield went from 0.44 the day of the July 30th Fed meeting to 0.55% on 11-21-25. The chart of the 10 – 2 Spread is HERE.]

Large, small, and mid cap stocks will all benefit from the prospect of lower interest rates. The market will likely continue to favor growth over value within SPX Large Caps meaning SPYG as well as QQQ vs. SPYV, Small Caps IWO vs. IWN and Midcaps, IWP vs. IWS). [11-24-25 NOTE: Small caps (IWM and IWO) rose but peaked shortly thereafter on 10-15-25 and then double topped a bit lower and came down after the 10-27-25 high. IWP peaked at a lower high on 10-27-25.]

Eventually with rising inflation into year end (with a dip for the Aug. report), the 10 Year Yield (TNX) will rise, further steepening the yield curve. That means that the 10 Year Treasury Yield, TNX can fall up to the time of, and then following the next CPI reading for days to weeks, but it will then rise into year end. [11-24-25 NOTE: Inflation may fall now, with oil prices down and falling, and Trump taking off food tariffs and other massive punitive tariff levels on countries like Brazil. An exception is China, which still has onerous tariffs on its imports into the US, and made a pretty bad deal with Trump.

That means that the 10 Year Treasury Yield, TNX can fall up to the time of, and then following the next CPI reading for days to weeks, but it will then rise into year end. [11-24-25 NOTE: It turns out TNX may be making a lower high now. Yes, things can change fast, so it may now descend to the October or the April low.]

11-24-25 NOTE: Although the economy is slowing somewhat into year end, growth is expected to pick up in H1 of 2026. That makes navigation of this decline tricky, as the markets may start pricing out the slowing and start pricing in the acceleration due in the first half of 2026.

The markets will guide us through it, so keep in touch via social media via the links below…

Keep up-to-date and read my comments on the current setup during the week at the above links) where a combined 37,184 investors follow the markets with me…

and because it’s good to have a backup…

or on the oligarch’s network… 😉

Real time messages are on StockTwits as always and appear a bit later on BlueSky, and then on X/Twitter (following me on two platforms ensures that you have a backup to get my posts btw, when one may be down. It happens…).

Thank you for reading. Would you please leave your comments below where it says “Leave a reply”… or ask a question if you like…

Pay it forward by sending the link to MarketTiming.Blog (that link will immediately connect them to this webpage) to a relative or friend. Thanks for doing that. I appreciate it, if you took the time to do that!

Be sure to visit the website for more general investing knowledge at:

Standard Disclaimer: It’s your money and your decision as to how to invest it.

Copyright © 2025 By Wall Street Sun and Storm Report, LLC All rights reserved.