A Market Timing Report based on the January 26, 2024 close…

3-08-2024 Update “The Third Eye of Investing”…

I wrote this up in response to a follower’s question on StockTwits. It was a general question about how to connect the economic data of the day to the question, “What happens to the equity markets?”

In what way do you use three eyes to invest? Keep one eye on the economy, but keep three eyes on what the markets are doing.

Three eyes? Yes. They includes your two physical eyes and your third eye, also know as your intuition, which can be prospectively developed over a lifetime.

I share what markets and stocks I’m buying and Bullish about using what all three of my eyes are seeing.

What I’m buying and selling is “my opinion” on the markets.

If a narrative doesn’t end up on a chart of a market, which drives my “buying” and “selling” as decisions, it was wrong.

Narratives are not secondary, they are often tertiary or worse in my view in relative usefulness. “Trump is not good for the market.” Market went up. “Biden is not good for the market.” Market went up. “There is no way we’ll avoid a major recession with a 50% drawdown, because the inversion of the yield curve is 100% predictive of a recession.” Look where we are. At all time highs in the major U.S. indexes.

A recession may come, but it didn’t come when we were told it would by historical statistics.

There are overpriced assets despite the overall trends, so risk manage them vs. calling the exact tops (by exiting on a strong signal to do so, or cutting exposure levels fast or in steps when the picture changes, the one seen by all three of your eyes!). IMO…

You have to decide what levels of risk you can live with and adjust your own process and exposure levels accordingly, but whatever you decide…

Use all three of your eyes to make your decisions! 😉

2-23-2024 Update “The Bearish View of the SP500 Index and How Rising Long Term Rates Could Create a Sizable Pullback”…

See Update on this Update HERE. When things change, we seek to see the change, not deny it…

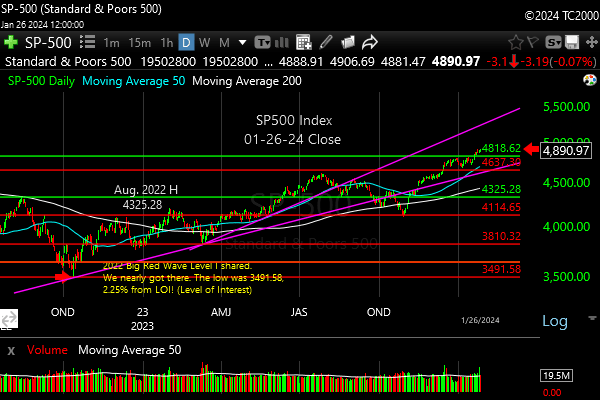

1 Note the SP500 Index market timing chart is Bullish despite the risk of downside after a very abrupt run starting with the Fed meeting back in November. I’m Bullish, because the markets I’m buying and holding are Bullish.

But we need to watch the risks to the rally, probably to simply be ready to add more exposure on a pullback…

2 Interest rates did NOT in fact reverse, and this is the biggest risk to stocks, IF it becomes extreme, which I’ve been alerting you to on social media. They are rising, which poses a risk to equity valuations that are measured by many against the rising 10 Year Yield.

3 On the Bullish side, the economy is strengthening despite the lousy earnings for many companies that are NOT leading the indexes at the moment. The strongest earnings driven companies are doing the work for the indexes that are cap weighted (to make the influence of larger caps greater). It will continue to strengthen during 2024, which could support a further extension of the uptrend.

4 Growth stocks are being favored over value, which is also Bullish. That doesn’t happen in a slowing economy.

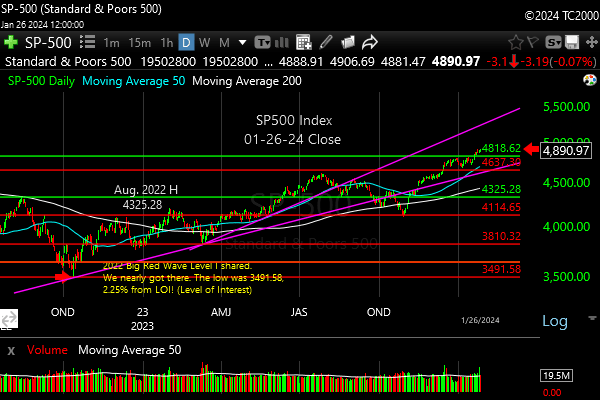

So what’s the Bearish chart view? It’s that this is a rising Bearish Wedge, and IF the wedge is broken to the downside, it will take the price down to some support level on the way to the worst predicted level, the latter of which would wipe out all the gains since the current rally began on Nov. 1st, which by the way, was based on the potentially false premise that the Fed is done raising interest rates.

On the day after the Federal Reserve FOMC meeting, Treasuries rallied strongly as rates broke down, and reversed the prior uptrend. That moment for SP500 Index is just a couple days off that bottom purple line. Nov. 1st was the reversal day for SPX, and Nov. 2nd was “lift-off day” for the rally we’ve been in.

Alternatively, we can stop at one of the three other lines shown, which are from top down, the green (pr. ATH), red (lower LT trend line), or blue (Aug. 2022 H) lines. I would favor that it won’t reach that purple line. One of the other levels will stop the fall IMO…

I do not believe we’ll get to the lowest retracement line, if the economy does in fact strengthen from here, and I view any breach of the wedge as a buying opportunity, but I don’t buy in size until my indicators say to add on such pullbacks, so stay connected with me on StockTwits (better as they are real time posts) or Twitter (delayed posts; hey, Elon cut the auto-posting from StockTwits!).

CLICK THE CHART TO EXPAND IT AND SEE THE DETAIL… 😉

Where a Break of the Bearish Wedge in the SP500 Index Could Land

Follow Me on StockTwits® or Follow Me on Twitter® (real time messages are on StockTwits)

Another update on Bitcoin Trading…

2-14-24 Update “How to Add to a Bitcoin Position During a Strong Rally and How to Trade Bitcoin in Your Sleep”…

Here’s a tip on adding to your Bitcoin position… Beginning on 2-5-24 through today, each day the low was at 35% or higher in the Opportunity Range™ for the day. That range is a prediction for what two prices will contain the range for a given day, and it changes daily. That means if you look for deep discounts in a strong rally like this, you won’t find any opportunities to add!

These are the percentages the lows reached within the range over that period, day by day from 2-05-24 to today… 35% 41% 43% 74% 60% 52% 52% 38% 35% and 47% (today).

That means if your rule says you won’t buy Bitcoin above 20% in the range for the day, the market will leave you behind in one of these powerful rallies. And they wonder why there’s a thing called FOMO. 😉

And remember that since it trades 24/7, it could offer the best price when you are asleep! That’s the downside of the blockchain. It never sleeps! Couldn’t they have built a break into the code? 😉 But you can trade while asleep….

P.S. Here are ways to trade in your sleep… You can set “limit” prices at all brokers with serious trading platforms, but you can’t set “stop limit” orders at all exchanges.

The advanced trading function at Coinbase allows it though. Why use such an order? The trade goes off when you hit the buy stop, but won’t execute if it’s fallen below the buy limit for downside that you set.

That means if Bitcoin were to fall from 50,000 to 48,000 in a few seconds (unlikely you may think, but it has happened multiple times in the stock market due to Flash Crashes), if your buy stop was 50,000 and your buy limit was 49,900, it won’t go off until Bitcoin rises back into your range. It has to trade with enough volume to cover your trade between 49,900 and 50,000, or it won’t happen.

Without a buy stop limit order you might be stuck with buying it at 48,000 in a sharp decline that could go much lower…

One risk? A risk to consider is that your trade might not go off, because it never reaches your stop, or it jumps over the range you’ve set only to land on a higher price on the rebound, but I’ve found in practice it often works when you adjust your prices for the volatility of whatever you are trading. Orders are generally executed in order of their submission, so don’t use round numbers like those in the example for the buy stop. Use 50,010 for the buy stop number to avoid a crowd at 50,000.

The disadvantages of trading and not being alert to what happens next are obvious, but consider the fact that Bitcoin is going to move up and down while you sleep anyway! If you buy it at 11 pm before bed in New York, it could fall or rise 2,000 in Japan 3 hours later. 😉 It’s not really new. The gold, currency, and stock market futures markets to name just a few are also open all night while you sleep!

Going back to the original post… I’ll cover some major issues facing the markets, including both upside opportunities and downside risks…

Key Risks and Opportunities for 2024

Number 1: The 2024 election is going to be a mess. This will create a buying opportunity at some point. You may not agree with the assumptions I’m making due to your political views, but remember I’m talking about growing and preserving wealth, not “who should win.” Here is why…

Former POTUS Trump may be convicted as a criminal prior to the 2024 Election in one of the four trials he faces. The odds of that happening before the election are very unclear however…

To this point in time, Trump has only been found “civilly liable” for sexually assaulting and defaming a woman, E. Jean Carroll. A jury found that and another found that he had defamed her while President and continued to do so, which is why the verdict was so huge. Trump defied the law. He acts as though the judicial system is optional for him. Courts and juries HATE defendants with bad attitudes toward right and wrong and justice, and they express it through their verdicts.

On top of that, Trump’s main business entity has been found to be corrupt by undervaluing properties to get lower insurance costs (cheating the insurance companies) or better loan interest rates by overvaluing properties (cheating the banks and cheating you out of a cheaper loan if you did NOT overvalue your properties). He may lose control of his businesses and have to pay huge fines, but the Attorney General decided not to pursue criminal charges (though they may appear in the future as referrals). Republicans seem fine with criminal activity as long as there is no criminal conviction.

In the case of a criminal conviction however, both a sizeable percentage of registered Republicans and right leaning Independents say they will not vote for Trump in the general election. That creates great uncertainty.

Special Prosecutor Jack Smith intends to bring a speedy trial on the January 6th charges. Trump’s assertion of immunity will fail, because it’s absurd. If a President had full immunity against any crime, he could kill 1000 of his opponents on the last day of office and get away with it. There would be no time for Congress to impeach him. He should have immunity for ordering a strategically legitimate strike on a terrorist leader as an example, but if he abused that power to kill random people for trivial reasons, he would be impeached, convicted, kicked out of office, and then might be tried for murder as a private citizen.

That last part is unclear, but would likely occur if he were not removed by Congress before leaving office. It could be argued that “removal from office was his punishment,” unless the killing could be shown to be completely unjustified.

For Jack Smith to get to court prior to the election, the district court of appeals involved must order the case returned to the court originally trying the case, or it could hold the process up past the election per Elie Honig, CNN legal analyst. In the documents case, Judge Cannon in Florida may be biased in Trump’s favor as a Republican judge appointed by him, so a case about top secret documents being taken and shared with random guests without security clearance at Mar-a-Lago may not be concluded before the election. Even the GOP Special Prosecutor assigned to the Biden documents case said Trump’s defiance of the National Archives requests was completely different than the case of Biden.

In sum, none of the Federal criminal cases against Trump may be decided prior to the election. The Georgia case may be delayed too, and the NY case, which may be heard by a N.Y. court first, won’t stop Trump if the penalty does not include jail time. That means he could be re-elected, then convicted, leading to a House impeachment and removal after Senate conviction, followed potentially by criminal trial(s) once he’s out of office, so if you vote for Trump, realize his VP pick may become president.

Finally, I previously have written about the 14th Amendment approach some states are using to try to ban Trump from their ballots as an insurrectionist. Recently, Ellie Honig, a legal analyst on CNN seemed to discount this possibility, but a close friend of mine with legal experience believes the right wing court members will have to side with the states, because they are not allowed to rule on the facts of the state determinations on Trump that were heard by the courts below them, only on the constitutionality.

FOLLOW UP on 2-11-2024… I listened to the entire court proceeding and concluded along with the legal experts that Trump likely won his case against Colorado (that’s from their comments, but they still have to rule on the case). The Supreme Court is afraid of the consequences IMO, and is shirking the need for them to define what an “insurrection” is under the law, as Colorado’s lawyer was urging the court to do. He said it did not matter that a number of states could bring cases that end up in SCOTUS, because it was SCOTUS’ job to resolve such conflicts! I agree with him.

However, that means (unless SCOTUS surprises everyone and Trump loses the case) Jack Smith in the Jan. 6th case and/or Alvin Bragg in the hush money case will have to convict Trump prior to the election to stop him.

This is now highly unlikely after we heard how afraid the court is of the consequences of a single state making a decision about eligibility –> The U.S. Constitution gives states this power and there COULD be [could have been] a unanimous SCOTUS decision to back the state by state decisions on Trump’s disqualification from the ballot.

A conviction by Smith or Bragg could result with the GOP having an unelectable candidate on the ballot as reaching 270 Electoral College votes would then be impossible for him, because many Republicans and even more Independents (who are in the majority) say they won’t vote for Trump if convicted.

Right now many voters in the Republican primaries seem oblivious to the risks I covered here.

The key for the markets? Markets hate uncertainty. They trade DOWN on uncertainty, and given the amount of it, it would seem unlikely that we’ll avoid a 10-20% drawdown prior to the election. I profited nicely from the “election jitter play” during the last two cycles, and I intend to make money on the chaos this time too!

Robert F. Kennedy, Jr. may upset the markets more than most voters understand.

The reason is RFK Jr. is polling across the nation at about 25% of voters (which adds up to the total percentage of anti-vaxers EVEN before Trump sped up the creation and production of the COVID vaccines per polling.)

The only way for an Independent to win the presidency is to build an independent party in the Congress (particularly in the House) from the ground up. Why? Because if no candidate reaches 270 Electoral College votes, the election is decided by a majority of House state delegations, the majority of which are currently controlled by Republicans. Those little red states add up! Unless a few of those states are flipped blue and the delegations vote according to the way the voters in their state voted, the GOP nominee would become president.

It’s highly unlikely that someone with the extreme views of RFK Jr. will get to 270, but he could block Biden and the GOP nominee, now presumed to be an UNconvicted Trump from getting there.

Number 2: The Economy is NOW NOT (updated with new FactSet Data on Feb. 16th!) slowing over the next 2 quarters for the average company not in the top 6 of the “Magnificent 7.” All but Tesla among those seven is per analysts adding to earnings growth for Q4, although the other 6 still have to report earnings. Tesla’s report disappointed investors.

Per FactSet on Jan26th, “For the fourth quarter, S&P 500 companies are reporting a year-over-year decline in earnings of -1.4% and year-over-year growth in revenues of 3.2%. For CY 2023, S&P 500 companies are reporting year-over-year growth in earnings of 0.2% and year-over-year growth in revenues of 2.3%.”

By Feb. 16th, FactSet said, “For the fourth quarter, S&P 500 companies are reporting a year-over-year growth in earnings of 3.2% and year-over-year growth in revenues of 4.0%. For CY 2023, S&P 500 companies are reporting year-over-year growth in earnings of 0.9%

and year-over-year growth in revenues of 2.4%.”

So in fact, FactSet is not now seeing negative earnings growth for Q4 2023.

Factset said on Jan. 26, 2024, “For CY 2024, analysts are projecting earnings growth of 11.6% and revenue growth of 5.4%. That’s great, but it’s going to be weighted toward the second half of the year.

Feb 16, 2024 Update by FactSet: For CY 2024, analysts are projecting earnings growth of 10.9% and revenue growth of 5.4%.

Furthermore, although growth will continue during H1 (1st half), GDP growth will be slower vs. the prior year into the second quarter, which the market will see as negative. Market’s respond to acceleration in earnings and revenue more than they do to growth alone. Remember too, this factor will be more detrimental for some stocks than others.

Companies not meeting their earnings expectations will be punished as usual… Consider for example that Factset says per analysts in Q4, the top 6 companies are expected to have grown their earnings by 53.7%, while the other 494 companies in the SP500 Index will experience earnings declines to the tune of -10.5%!

Be aware if the companies you own will show accelerating earnings and revenues or not for 2024. Those they are not will likely be punished. You can look up the data on Yahoo Finance for free under “Analysis” for any given stock symbol.

Number 3: Interest rates need to move down from here or at least from a bit higher, as I explain in detail below in the “10 Year Yield” section. We can make a lot of money in long term bonds, if certain things happen that I lay out below…

How my various systems that monitor the markets work together…

I’ve been sharing key “Opportunity Range™” data on social media including the SP500 Index (SPX), the Russell 2000 Index (RUT), GLD (Gold ETF), and the 10 Year Treasury Yield (TNX). I added Bitcoin to that list recently. The ranges tell me when to add to uptrends and when to exit when the trends are broken.

The ranges define the likely short term trading range of whatever stock or ETF I choose to look at. They do not protect against big surprises (when volatility skyrockets), as only inside traders can do that, but the ranges are great at trading within trends, as well as identifying some of the big “morphs” in trends as I call them.

I also report on important trend changes among 65 different markets and sectors on social media regularly as my long time readers know. And that includes my buys/sells as they come. Since this has been tested over the years in a general way and more specifically using new criteria in a specific way for over a year now, it’s time we put the rules to work…

I combine those two systems with my Market Indicator Panel™, which help me time the big market moves in stocks. What results is a full set of tools to manage a portfolio!

To be up to date on my latest insights and buys/sells, be sure to…

Follow Me on Twitter® Follow Me on StockTwits®. (real time messages are on StockTwits as always and mostly appear a bit later on Twitter)

Keep up-to-date and read my comments on the current setup during the week at Twitter and StockTwits at the above links) where a combined 36,458 investors are following the markets with me…

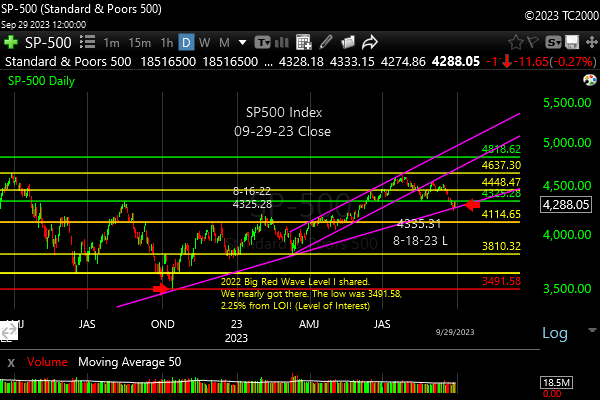

1. SP500 Index Market Timing (S&P 500 Index®; SPY, SPX):

We have new all time highs in the S&P 500 Index, which means the market can go even higher, and the status is “UpTrend™.” The top 6 stocks have to continue to perform in earnings terms though for that to happen. Watch for a reversal if their earnings are disappointing this week. If you see a LOSS of the prior all time high (ATH), that will spell trouble for the U.S. stock market.

Click the market timing chart to see the details… (the lower RED arrow marks the October 2022 low)

New all time highs.

Now let’s review investor sentiment…

Survey Says!

The AAII Survey of Individual Investor Sentiment (AAII) spread is +13.2% (Bulls – Bears). That’s not a huge positive spread, and Bulls have come down from their peak at 52.9% on Dec. 20, 2023. That means there is room for upside or downside from here, and it’s not a great help beyond showing there is a lack of an extreme.

|

|

|

|

| Bulls |

Neutrals |

Bears |

| 39.3% |

34.6% |

26.1% |

|

|

|

| Thurs. 12 am CT close to poll |

Now let’s look at the small caps, gold, and interest rates…

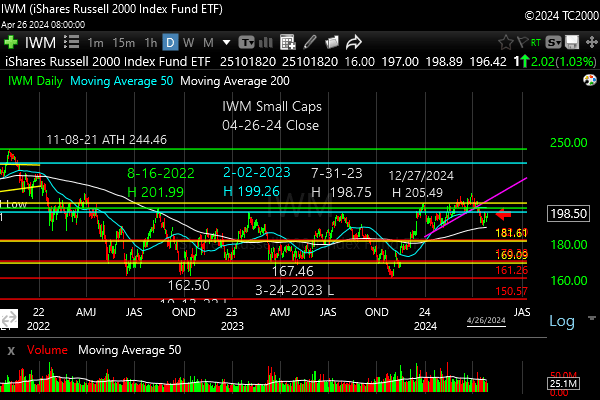

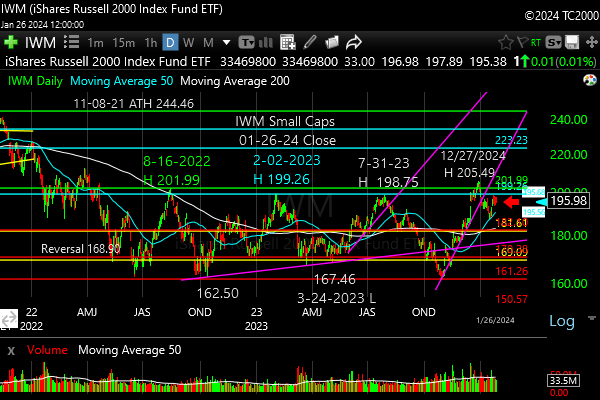

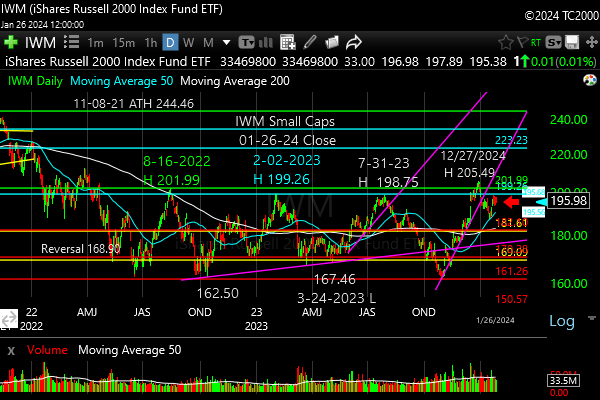

2. U.S. Small Caps Market Timing – Russell 2000 U.S. Small Cap Index (click chart to enlarge; IWM, RUT)

If the most recent dip lower in small caps is broken, this bounce will be verified as over, and the failure to hold above those prior highs shown on the chart is a negative. I would characterize this trend as a “Bouncing DownTrend™” “On Watch.” Why not downgrade the trend now? Because it could be the pullback to the 50 day moving average shown was a Wave 4 correction which has given way to a Wave 5 bounce. Just remember that a Wave 5 bounce can stop at the prior high and collapse from there.

The Bulls need a new high above all the highs shown from 8-16-22 on to change this into a full fledged UpTrend™.

Must bounce from here or the recent bounce will be verified as over.

Gold is next…

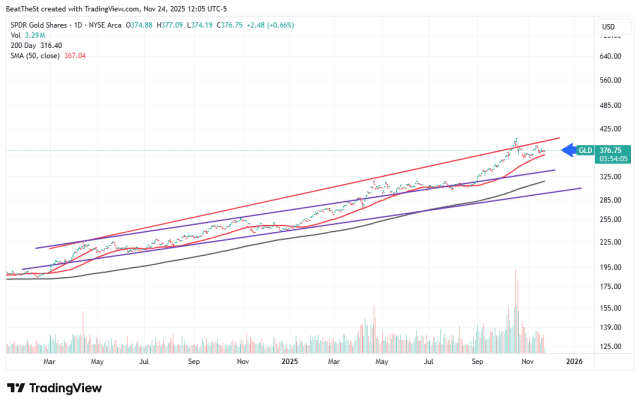

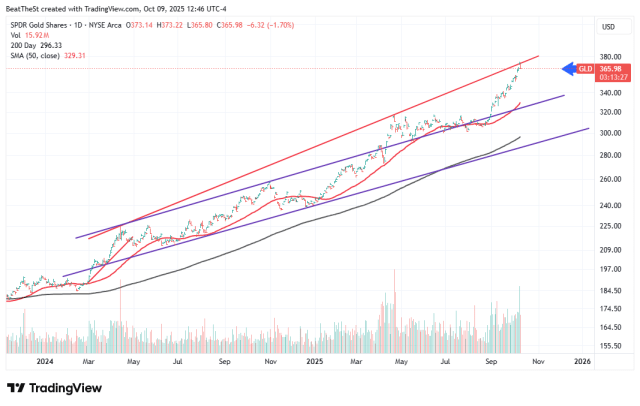

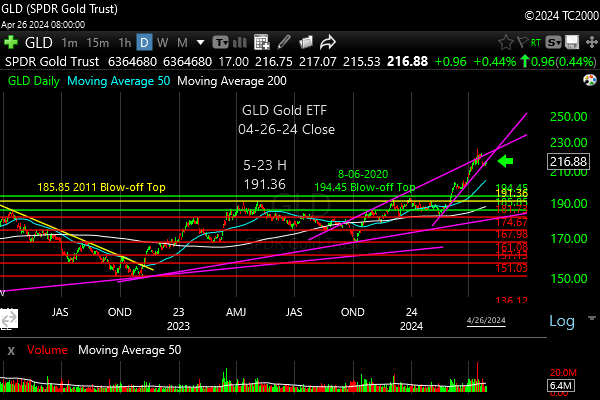

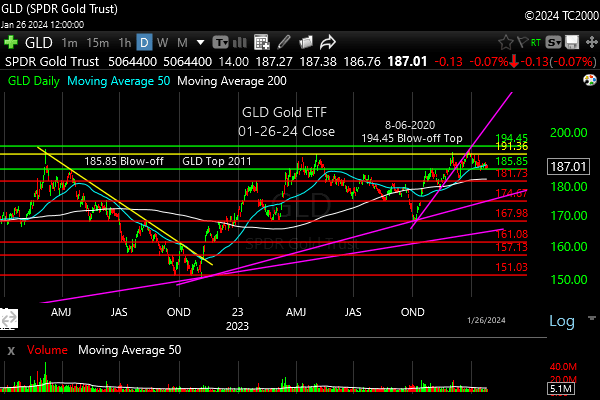

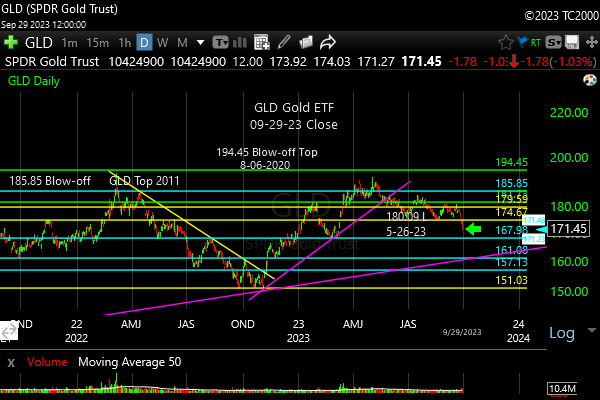

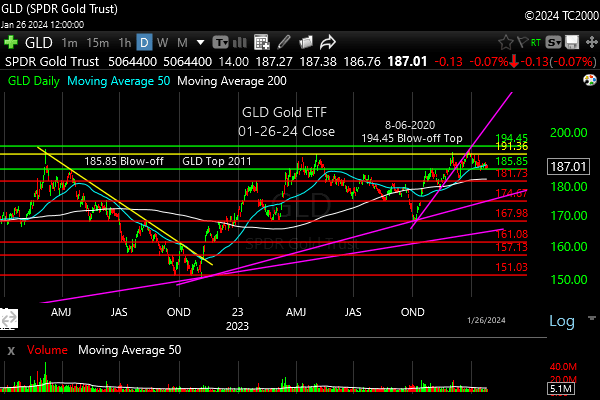

3. Gold Market Timing (click chart to enlarge; GLD):

Uptrend won’t hold if interest rates don’t come down from here.

In my last report here, gold was in a DownTrend Type 1, and I said, “If rates start falling again, gold will recover, and you may want to rebuy that which you have sold. That’s trading life in a nutshell!”

Gold in fact stopped falling just a few trading days later on Oct. 6th when it bounced from the magenta long term support line shown. The 10 Year Yield, which I will review next, peaked on 10-23-2023 at 4.997% and then fell, but has been rising since 12-28-23 to a level of 4.160% most recently.

One favorable scenario for gold investors would be that the economy slows, interest rates fall again anticipating Fed easing, and then the Fed eases causes real interest rates to fall. If the economy does NOT slow, then if the Fed STILL cuts rates, inflation may pick back up, driving rates back up and gold down. If the Fed IS able to lower rates despite a stronger economy, gold would be OK with that, although money tends to be competed away from gold in that kind of “goldilocks” economy (accelerating GDP growth and falling interest rates) and moves into stocks.

This is why we follow everything together simultaneously here. It’s the whole picture that really tells the story, not one data point or another.

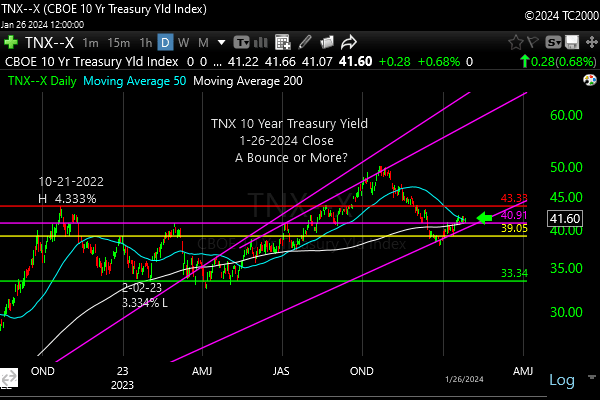

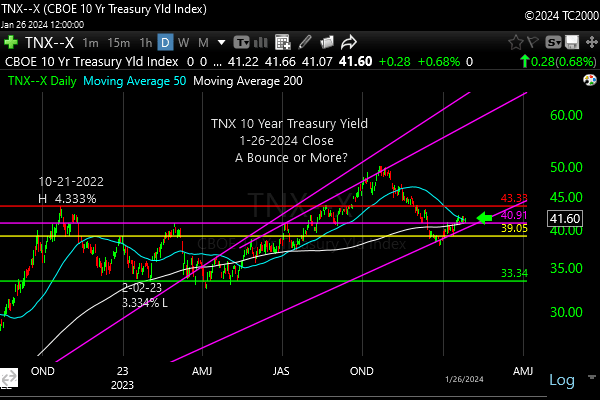

4. Interest Rate Market Timing (10 Year Treasury Yield; click chart to enlarge; TNX, IEF, TLT):

Last time I warned that a move of the 10 Year Yield above the 4.333% level would be trouble for stocks. In fact, stocks broke lower the day that happened, and eventually traded down to the Oct 17, 2023 SPX low of 4103.78.

A hard bounce in stocks happened on the afternoon of the Federal Reserve meeting statement release and press conference on Nov. 1, 2023 that has continued to last Friday, with small corrections. Why? Because rates fell!

The 10 Year Treasury Yield peaked on 10-23-23 at 4.997%, hit a low of 3.785% on 12-27-23, and has bounced since then but settled this past Friday on 1-26-24 at 4.160%. It is consolidating ahead of the Fed meeting that will end on Wednesday with the statement/press conference.

If the Federal Reserve pulls back on interest rate cuts, we could see the yield continue higher from here. Stocks will need rates to start moving lower again very soon, or this rally will take a pause or more likely fail.

Note that the 10 Year Yield is still above the very long term uptrend line coming up from the 2020 low (lower magenta line). In that sense, the uptrend in rates was interrupted in October, but not stopped. Not yet…

However, I’m giving the edge to the Bulls here provided TNX stays below that 4.333% number or fails to hold above it on a test.

If the yield can fall from there or even from right here, the next wave is the Big Red Wave Down, Wave 3 of 5, the longest wave. That would mean tremendous gains for long term bonds and Treasuries.

Market timing is going to be a VERY useful tool this year, as it has in prior election years!

Here’s the current chart…

Rates need to come back down or the stock market rally will falter or fail. If rates simply keep rising from here, stocks will correct dramatically.

Now let’s review three key market timing signals together….

Do not use these signals as a trading plan. They are rough guidelines. I currently share my actual BUYS and SELLS in as timely a way as possible on social media (links above).

MY MARKET SIGNAL AND TREND SUMMARY for a Further U.S. Stock Market Rally with Real GDP Growth (“Real” means above inflation):

Stock Signal Bullish (on watch, because this signal looks at small caps) for a further U.S. stock market rally with a short term Bullish and longer term Bullish SP500 Index trend. The small caps determine the stock signal in this section of the report. And the longer term trend must hold as explained above!

Gold Signal Neutral for a further U.S. stock market rally. The Gold Trend is short term Bullish as it is “On Watch” and longer term Bullish as it’s above its longer term trend (see discussion above).

Gold will take off again to the upside IF/WHEN 1. Rates start falling again at the long end (10 years or longer). 2. The economy slows 3. Earnings fall for stocks, which reduces the overall yield on stocks. Gold likes weak competition and particularly falling real interest rates, which also tend to weaken the US dollar!

Kept for Reference: “Gold can RISE with stocks when real rates are FALLING, and the dollar is falling. Gold could rise WITH the dollar if the economy slows and real long rates fall.

These are thing gold doesn’t like: 1. Rising real rates (bonds/Treasuries become a threat to gold which pays nothing; banks and other companies make more money with rising rates) and 2. Economic recovery with higher corporate earnings. Earnings drive stock prices higher. Stocks pay dividends that compete with bonds, and companies use cash to buy back stock, which drives up stock prices, while gold pays nothing.

In liquidity crunches (which the Fed is supposed to prevent) gold can drop with everything else but the US dollar.”

What gold does mostly as I’ve written HERE is follow real interest rates around the world (if you own “gold in dollar terms” you care about U.S. rates most of all). The rest of the world does matter however, including massive buying by central banks. Real interest rates have been rising around the globe. Economic slowing is creeping in now, which means ultimately real rates will fall again if the Fed suppresses growth.

GUIDE: “Remember GLD is being used as an indicator for the ECONOMY here.” If gold continues to rise again, it means the market believes real rates are going to fall or stay negative for a period of time.

Rate Signal: At this point Bearish for a further U.S. stock market rally, as rates have risen again in the very short term (just less than a month as of the end of Jan.). The 10 Year Yield trend is short term Bullish, and longer term Bullish (meaning RISING). HOWEVER, I’m giving the edge to the Bulls here to turn things around provided TNX stays below that 4.333% number or fails to hold it on a test.

(Remember: higher rates mean lower bond and Treasury prices and vice versa). We want slowly rising rates in a recovering economy. That’s what happens normally. The Fed raises rates slowly as the economy continues to grow until it doesn’t. What we don’t want is rapidly rising OR rapidly falling rates, both of which I call “Rate Shocks.” The Rate Shock we saw in 2022 was due to the Fed raising rates at the fastest rate since the 1980s.

Thank you for reading. Would you please leave your comments below where it says “Leave a reply”… or ask a question if you like…

Pay it forward by sending the link to MarketTiming.Blog (that link will immediately connect them to this webpage) to a relative or friend. Thanks for doing that. I appreciate it, if you took the time to do that!

Be sure to visit the website for more general investing knowledge at:

Sun and Storm Investing™

Standard Disclaimer: It’s your money and your decision as to how to invest it.

I thank Worden Brothers for the charting system I use to post these charts. If you want to know more about the charting system I use every day, contact me for any questions, or click HERE. Please use that link when you sign up as I am an affiliate (I don’t make much, but it may help to pay for some of my website expenses). It makes it much easier to follow along with me if you can see the charts and manipulate them on your own computer. It’s a great investment to have an excellent charting system.

Note: I’ve updated my criteria for the equity signal for a further U.S. stock market rally to the following: GREEN = Bullish, YELLOW = Neutral, RED = Bearish. In other words, the colors tell you whether the signal supports the stock rally or not, while the Bullish, Neutral, and Bearish designations are about the trend.

A BEARISH trend signal does not mean we should not buy. A BULLISH trend signal does not mean you cannot sell some exposure. It depends on what is going on in the economy and how oversold/overbought the market is at a given point whether the Bearish signal is to be sold or bought, sold on the next bounce, etc. and whether a Bullish signal is to be bought or if profits should be taken. A NEUTRAL trend signal does not mean the end of the Bull or Bear. It means to wait and look for possible subsequent entry points within the existing trend, Bull or Bear, but preserve capital if the entry fails. Our strong intention is to buy low and sell high. By the way, I will keep showing the prior orange “Trigger lines” in the IWM and GLD charts for now as reference points only; they have historical value for us from the post-2016 election period.

Copyright © 2024 By Wall Street Sun and Storm Report, LLC All rights reserved.

Continue reading →

Share this with Facebook, Twitter or by Email: