“What makes gold work as an investment and when does it become a portfolio disaster?”

(Written 5-11-2015 and Updated 2-15-2022)

When Does Gold DECLINE?

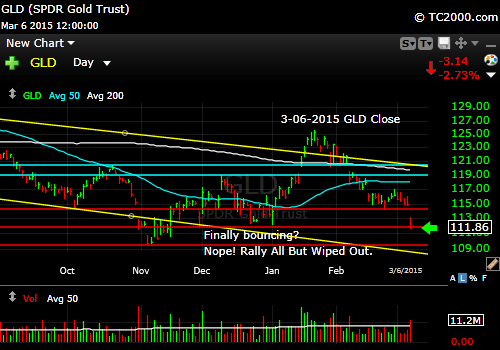

Let’s handle the “bad news” first. I said in my update of last week’s blog post: “Gold is not a good trading idea if the economy is indeed going to improve dramatically.”

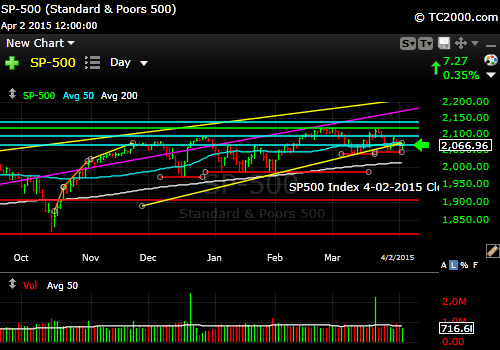

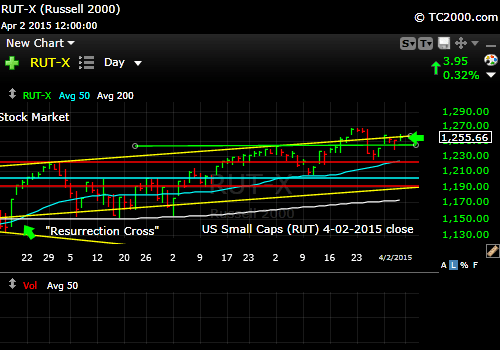

If the economy is booming, stocks are rising rapidly, interest rates are rising ahead of inflation keeping real rates positive and rising, and the U.S. dollar is strong, gold does horribly. You don’t need dollar insurance when the dollar is rising, and you don’t need to protect yourself against a decline in stocks when the economy booms for years in a row. That’s why gold was a horrible investment in the 1990s. There was a huge economic boom, despite the bust to follow.

Gold competes with forms of yield whether it’s stock returns by price appreciation, stock yields, or Treasuries, bonds, and other interest rate bearing assets. Gold tanked in the late 1990s, because stocks were the best place to make money.

When Does Gold SHINE?

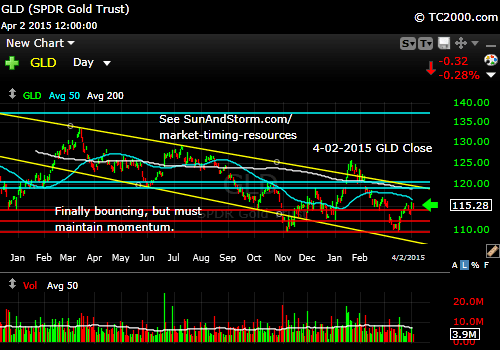

In economic terms, there are three “secret” ingredients needed for gold (GLD; gold ETF) to shine and two corollaries. They are secret if you don’t know them! This is essentially the flip side of what I just said above about when gold declines, but I spell out the details, so they’ll sink in better…

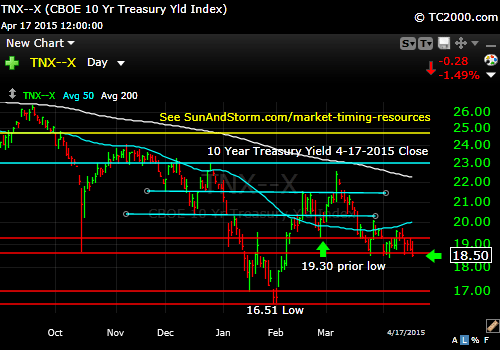

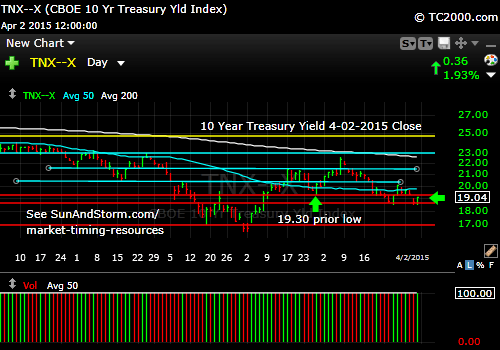

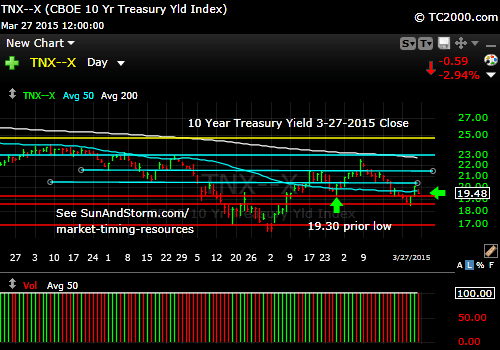

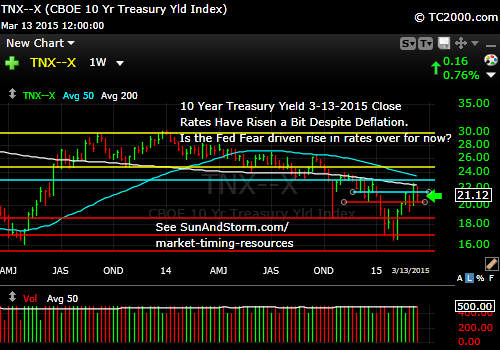

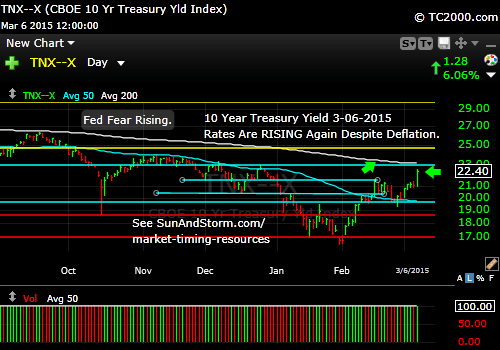

First, gold does best with negative and falling real interest rates, which means inflation above the rate of return of interest bearing instruments like bonds (10 Year Treasury Note (TNX), 30 Year Treasury Bond (TYX), corporate bonds (LQD) etc.). The rate of change of real interest rates can accelerate a move in gold prices as the market perceives that as a threat to price stability in either direction.

A rapid rise in rates generally will hurt gold and a rapid fall with generally help it, though not necessarily in a stock market crash. When a crash occurs investors need liquidity, so they may sell everything, even gold. In addition, Treasuries generally compete with gold during stock market declines of 15%+, because they have a real yield, and the U.S. dollar is often strong. Stocks are sold. Dollars are received.

During the COVID-19 Crash gold fell at first with Treasuries rising. Then gold rallied off the March low and U.S. Treasuries fell off their March 2020 high.

To clarify this further, falling real interest rates help gold, but falling real rates with already negative real yields on U.S. Treasuries helps gold even more. Why? Because gold has a ZERO yield unless you loan it to someone. If you hold it, you are making ZERO. You own gold to preserve the value of your assets, which melt away if held in U.S. dollars in a bank giving you a negative real yield (a yield lower than inflation). When yields are already negative, you can just sit in gold, even if real yields are not falling further, and you are still being protected vs. holding dollars.

Note, however, if real yields are rising, gold owners will tend to anticipate positive real yields to come and will tend to sell gold, even if real yields are still negative.

Summary of the Real Yield Impact on Gold: Buy gold when real yields are falling and especially when they are both negative and falling. Sell gold when real yields are rising and especially when they are both positive and rising, which is typical in an economy with accelerating GDP growth.

I could have listed “Falling Stock Prices During Economic Slowing with Falling Real Yields” as a factor, but it can be seen as a dependent factor vs. real yields.

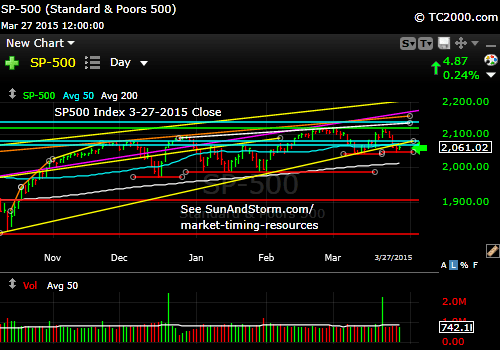

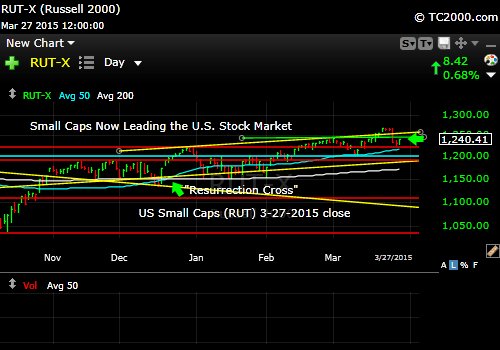

If stock prices are rising and real yields are also rising, gold does poorly. Why? That’s generally when the market’s rise is most powerful and sustained. Stocks compete away interest in gold.

Remember though that both stocks and gold can do OK if real yields are falling while economic growth is accelerating. Falling real yields win out over rising stock prices and push gold higher.

On the other hand, when the economy is slowing, investors will sell stocks as they fall with their earnings. Economic slowing helps gold if real yields are falling due to either 1. Inflation rising faster than interest rates during Stagflation (slowing economic growth and inflation) or 2. Deflation (slowing economic growth and deflation).

“Insurance Gold vs. Trading Position in Gold: Regardless of any of the factors discussed, you may choose, as I do, to hold some gold as a hedge at all times vs. various disasters. What I don’t do is hold a trading position in gold on top of my “insurance gold,” when the factors discussed here are working against the gold priced in U.S. dollars. (If you live abroad, simply adapt this to your own currency and interest rates.)

How much insurance gold should we own? Many say 5% but don’t state whether that is vs. net worth or investable net worth, so take your pick. Others say 10%. To me that is too high. I use 5% of total net worth. Where I rebalance to 5% depends on the gold chart.

Why not sell everything you own, including “insurance gold,” when conditions for gold deteriorate and then buy it all back when they improve? Remember, if you sell a long term holding in gold, you have to pay 28% capital gains at the long term income tax rate (same for GLD). It’s a collectible unless you use a derivative ETF as a substitute, which has its own issues. Plus, how do you time the need for insurance, when a sudden event like a tsunami can occur and create financial panic. It happened in Thailand. It happened in Japan.

On to the next important factor in helping gold shine…

Second, gold also does well when the currency it’s measured against goes down, not up. When the economy is weak, the Federal Reserve lowers the Fed Funds rate and longer rates fall as well leading to falling real interest rates. Those falling real rates drive down the dollar. Foreigners sell U.S. dollars. A weak U.S. dollar (expressed as the US dollar index) makes gold more valuable to U.S. citizens, because it then takes more dollars to buy it. A trend in this direction increases demand, speaking of which…

Third, gold goes up when it’s in demand worldwide. Demand means total trading demand worldwide, so gold naturally does best when it is rising in market timing terms in multiple important currencies worldwide than when it is just performing well in one currency. If gold is rising in multiple major currencies including the U.S. dollar, the Euro, the Yen, and the British pound, for example, gold often continues to do well. That condition would occur in a global economic slowdown with numerous key central banks lowering short rates.

This means that the trend itself is important, and to that extent, you need to do market timing of your investments in gold. Yes, gold often goes up, because it’s going up over a period of time that convinces the market that gains will continue. This means it can be overdone to the upside at times, and corrections ensue for example, as real interest rates change, or demand falls due to greater worldwide financial stability.

It is theoretically possible for influences like advertising to cause gold prices to rise. A big systemic shift in what financial advisors say about gold’s value as insurance or as an investment would help or hurt the price of gold.

A currency-driven financial panic can have a big effect on gold prices as we saw when the Euro seemed in peril. In that situation, the U.S. dollar AND gold can do well. They are both in high demand during a panic out of Euros.

The ideal environment for owning gold (GLD) is: 1. Negative and falling real rates of return on Treasuries and bonds 2. A weak dollar. 3. Sufficient demand worldwide vs. supply with rising prices in multiple major currencies.

Corollaries of Point #1:

A. If stock prices are rising and real yields are also rising, gold does poorly.

B. Negative real yields, even better when real yields are falling, win out over rising stock prices and push gold higher.

Supply is not a big issue with gold, because the supply is constrained by its rarity. It could have an influence if there were a lot of gold selling all at once as it is always in the end supply vs. demand as with anything else that is bought and sold.

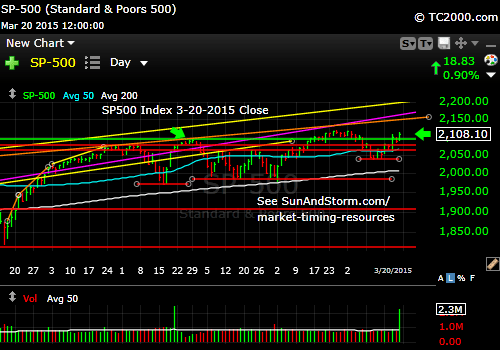

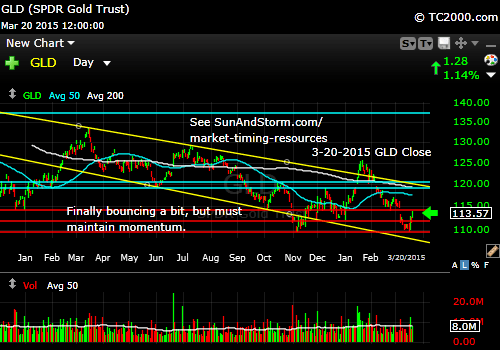

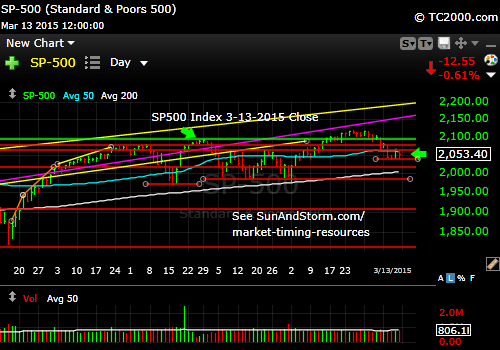

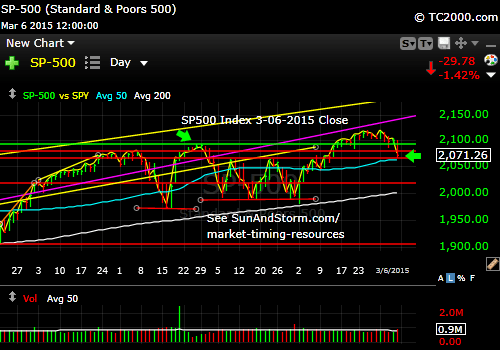

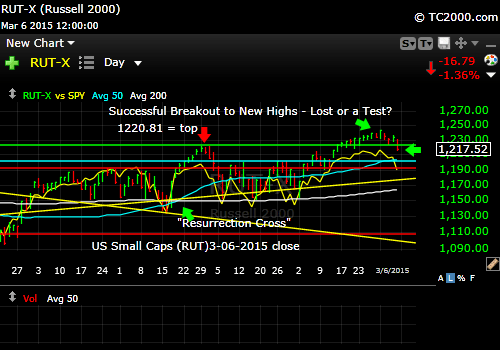

This analysis pertains only to this post, but is a good example of applying the above rules: Gold has been weak because “1” (see above) has been lacking with rising real interest rates, “2” is missing, i.e., the dollar has not been weak enough, and “3” the world is not in panic mode, so demand for gold has fallen globally. The weak dollar has been the main force preventing lower lows in the gold price. Gold is a hold as “insurance” in our long term view of gold as U.S. dollar insurance, and we have no trading position currently.

For now, if the economy remains sluggish, gold will do fine IF rates resume their fall and IF negative real rates prevail, while the dollar does not strengthen dramatically, which it should not if rates are falling, and the world is not in “Euro panic” mode.

If you read this at a later date, just apply the principles the same way we are doing here with the current facts. They will help you make a better decision on whether to buy or sell gold.

If you appreciated this post, please say so below in the box labeled “Leave a Reply” and post it to Facebook or other social media.

Thank you for using your valuable time to make a comment.

To find out what I’m doing, including buys and sells, please follow me here: Follow Me on Twitter®. Follow Me on StockTwits® You don’t have to make comments yourself to read my messages.

I cover foreign markets on social media (see links above) and in my monthly newsletter. Note that the newsletter is now closed again to new subscriptions: Join the Wait List to Join the Newsletter as a Loyal Subscriber, Opening again for the July 5th issue. If you join and don’t read the newsletter, you will be deleted. I don’t publish to non-readers as other newsletters do. Stay tuned here in the meantime and follow all the action via the Twitter® and StockTwits® links above.

Be sure to visit the website at: Sun and Storm Investing™

Standard Disclaimer: It’s your money and your decision as to how to invest it.

I thank Worden Brothers for the charting system I use to post these charts. If you want to know more about the charting system I use every day, go to my “Other Resources” page here: Other Resources It makes it much easier to follow along with me if you can see the charts and manipulate them on your own computer. It’s a great investment to have an excellent charting system. Check it out with a free trial at the link above.

Copyright © 2015 and 2022 By Wall Street Sun and Storm Report, LLC All rights reserved.