A Market Timing Report based on the 1-26-2018 Close, published Sunday, January 28th, 2018…

I deliver focused comments on market timing once or twice a week. These are supplemented with daily “Tweets/StockTwits” (see links below).

NOTE: If you are uninterested in Bitcoin, scroll down past the first three charts…

2-03-2018: Latest Bitcoin Update was published HERE. From this point on, all Bitcoin updates will appear as separate posts or separate threads of updates on the same post focused on Bitcoin.

2-02-2018 Bitcoin Update: Crash mode, but with some support lines. What can save Bitcoin?

The chart is below, but first, let’s go over what is driving things short term…

#SAUS:

Story: The story with India is definitely a big negative. The government has banned all transactions with Bitcoin to defend its currency. After all, why use the rupee if you can use BTC to buy your coffee? They are NOT yet banning it as a store of wealth, but this definitely decreases the UTILITY of Bitcoin as India is seen as a huge market, and a market that could provide leadership to other nations in restricting transactions.

Access: Bittrex is a popular exchange that has not allowed US dollar trades directly into BTC, but says it will do so now. Today would be a good time to do it; however, there is no intraday fix for access and this crash is happening now, not next week.

Utility: Big hit on utility as noted in the story section above. What BTC really needs is a big POSITIVE story to counteract the negative India story.

Safety: Tether is in the news as a possible fraud for being tethered to nothing vs. dollars, which was stated by them. They are being investigated. This does not impact BTC, Etheruem and other coins. So safety is not an issue here. The feeling of safety vs. a crashing BTC is an issue however and could scare a number of new investors off as they “freeze in the lights.” That impact further reduces demand on the way down.

What we saw in the chart previously was a pullback. What we have now is a crash with POSSIBLE support points that actually mean little until the market takes note of them and moves up. Several support lines worked for a day or two and were then broken. Understand this: Technicals will not likely save BTC. It will have to be fundamentals in my view especially if the above two lines are broken. You can always see a bounce to lower highs in a crash, so be careful what you bite on.

Now for the chart… The up trend line hits at about 7,500. Below there it’s all guess work. Right now Coinbase is quoting 7,907 as the price, a bit above there. Bittrex, which tends to be lower except during these big downdrafts is at 8,377.

You can also see that the down trend channel had support at about 8,000, so those are your final two support numbers. The upside on a bounce is that upper down trend line which is now at 11,100-11,200 as I view it in the browser. Price must rise above the top down trend line convincingly and move up for a recovery of the up trend to occur.

The downward wedge formed by the trend lines shown is bullish technically, but not a guarantee. It means that volatility is FALLING on the way down. Rising volatility in a down move would suggest a bottomless pit falling back to zero, but a wedge does not; however, no single technical factor is a guarantee, because the trend is still down for now. Beyond that, you can look at volatility ranges, but those were broken badly last night and provide only a very short term idea of the active price range of trading. Bottom line? Decide what you can afford to lose if you are under water and stick to your plan. No one can tell you what BTC is worth today other than what people are paying for it.

Support levels have not held.

1-31-2018 Bitcoin Update: Triangle Broken but Holding Support at a Lower Low

That’s not a good thing. We’re seeing lower highs and lower lows. Price has broken through the top slanted line, which is the long term trend line for 2017 into 2018. It has also broken the triangle in the prior chart (below) to the downside. The only thing left is a couple of support levels around 9000 and 10000. It must hold one of these to avoid serious further damage.

Bitcoin could really use a UTILITY boost like the lightening project increasing transaction speed. Without that, traders will decide the price. Demand tends to be tentative after a fall like this. The STORY has been under pressure with detractors falling over themselves to say it’s going to zero.

Increased ACCESS at Robinhood (cheap trading site) could help boost demand as they roll out that access to more and more states. SAFETY will improve with enhanced regulation. Remember unless you are criminal or a crook who does not pay taxes on gains, you should be happy cryptocurrencies are being regulated, because otherwise, they will be ELIMINATED for all but thieves trading between each other, which will be outside the developed world. Better to have regulation than lose everything.

Remember my cryptovaluation scheme: #SAUS. Story, access, utility and safety.

Bitcoin has to make a stand.

UPDATE 1-29-2018 Bitcoin Update: Triangulating.

Bitcoin will likely move in the direction of the break of the market timing triangle. Traders no doubt have an eye on this, as valuing Bitcoin is difficult. Lately it’s worth from $9,000 -$20,000! Staying above the horizontal line would be a plus. Breaking out above the top line of the triangle, better!

Triangulating. Follow the direction of the next break, up or down if you are trading.

Back to this week’s issue on the big reset in the markets…

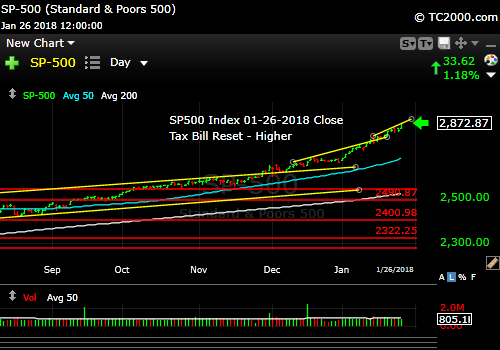

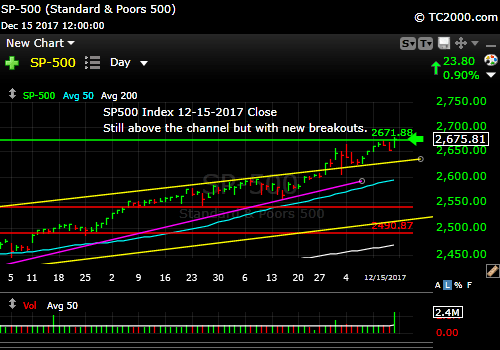

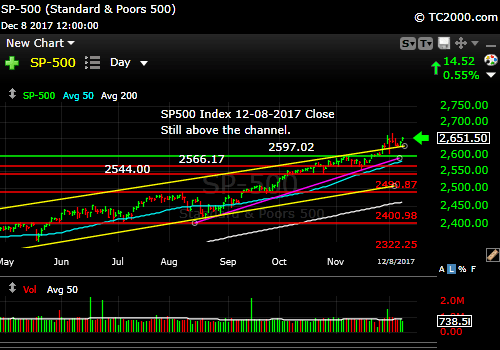

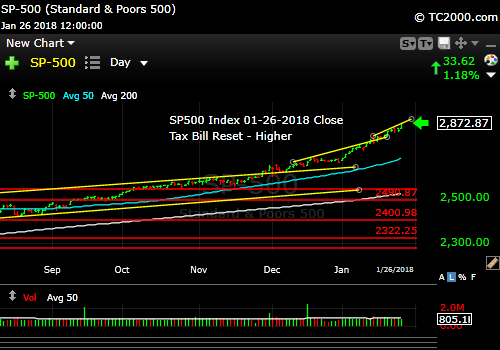

1. SP500 Index Market Timing: The market has continued higher, despite market timing signals that say it is a stretched. I’ve explained recently, and I think it’s important to repeat, this is in part due to what I call the “Tax Plan Reset” (#TaxPlanReset on social media).

Before the Tax Plan bill was passed by the GOP and the President, the market had certain expectations, but after passage, expectations are much higher. There are provisions in the tax plan that allow capital expenditures to be expensed in the first year rather than depreciating them over multiple years. This will add fuel to small business creation, which is where the majority of new jobs comes from. This means more business for the larger businesses serving them and those larger businesses also have the same new tax advantage. Lower tax rates for many companies (watch out for the losers!), will add fuel to the economy. We are spending money that should normally be saved against our debts in good times and spending it on growth. We will have to pay for this later, or rather our children will have to pay.

But for now, this means we can spiral up. Party on Garth! (anyone get that reference?) Remember the tax changes on depreciation make earnings look better in the short term and worse in the longer term, but it is still a boost to business, because capital NOW invested intelligently is worth far more than capital 5 years from now.

The other side of that coin is that businesses overpaying for other businesses with tax break money or repatriated money will be punished for using capital poorly. Repatriated money only has value if it is used well, which for shareholders means being properly invested or returned to them through increased dividends and buybacks.

There will be new businesses created through the new money available to the U.S. economy, but a good deal of it will enrich shareholders. This money in turn will be reinvested in the same or different stocks by many and some will be spent, fueling the economy, and driven stocks up in price.

This means we need to be patient in seeing the impact of the Tax Plan unfold, and that the market may go far higher than anyone expected, not just on the optimism investors have, but also on the magnitude of the fiscal stimulus.

The catch? The catch is that after the degree of optimism we saw among investors just a few weeks ago, there is invariably a correction in the market. It could be a modest correction (4-8% from closing high to closing low of the dip that follows) or more than modest (over 20%), but in my view it won’t be the end of the run for the Bull.

For anyone new to my thoughts, review this on the upcoming market correction: HERE (under sentiment).

Keep up-to-date during the week at Twitter and StockTwits (links below), where a combined 33,300+ people are joining in…

Follow Me on Twitter®. Follow Me on StockTwits®.

SP500 Large Cap Index (click chart to enlarge; SPX, SPY):

Increased expectations led to the Tax Plan Reset.

Survey Says! Sentiment of individual investors (AAII.com) showed a Bull minus Bear percentage spread of +21.42 vs +32.72% last week. After the extreme Bullishness reported on 1-04-2018, we can expect sentiment to bob up and down at a higher level, before easing. How much time do we have to the next correction? If it’s a smaller one after massively high sentiment, as in the three sentiment peaks occurring from 2004-2006, it will be in about 3-23 weeks from 1-03-2018. That’s simply historical data, not a crystal ball.

If it’s a larger drop as in 2011 (19.4% from closing high to closing low) after peak sentiment, it COULD be 18 weeks from 1-04 as an example.

To summarize, based on the prior experience with these massive sentiment peaks, the lag to correction big or small is from NOW (3 wks from 1-04 is now!) to 20 weeks from now.

These are just examples and the actual timing could be entirely event driven by an event we are not expecting.

| AAII.Com Individual Investor Sentiment Poll |

|

|

|

| Bulls |

Neutrals |

Bears |

| 45.45% |

30.52% |

24.03% |

|

|

|

| Thurs. 12 am CT close to poll |

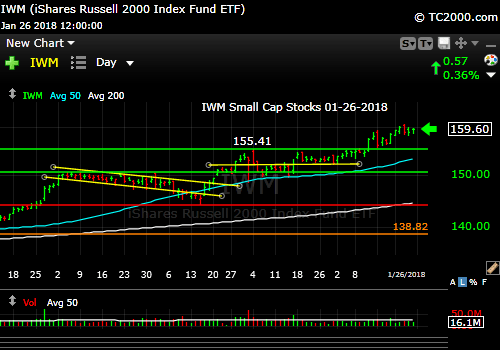

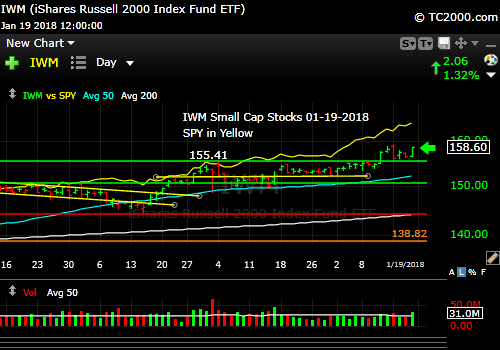

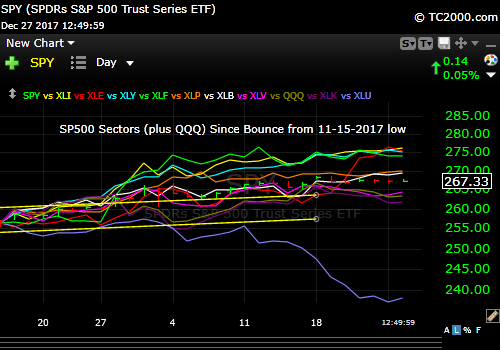

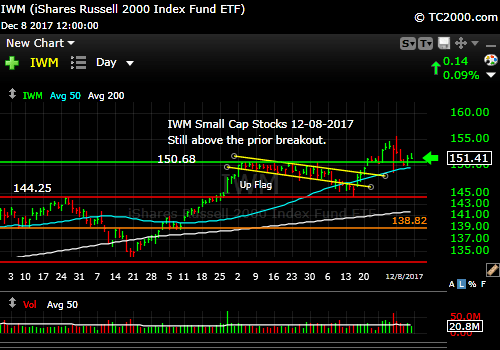

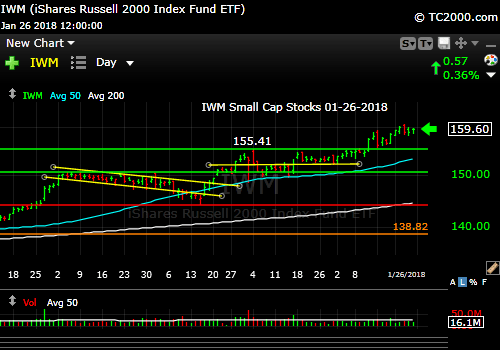

2. U.S. Small Caps Market Timing: Small caps under-performed large caps this week as they have since 1-16-2018 (take a look at last week’s comparison chart; link to upper right). This is a sign that investors are trimming their risk appetite, and we’ll need to keep a close eye on it, and do our best to use market timing to protect profits. It could admittedly simply be a pause to be followed by another move up. My main exposure to higher risk US stocks is in mid caps as I’ve said.

Russell 2000 U.S. Small Cap Index (click chart to enlarge; IWM, RUT): Longer term view…

Small caps lag large.

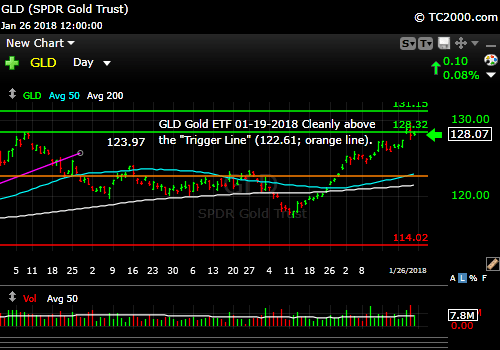

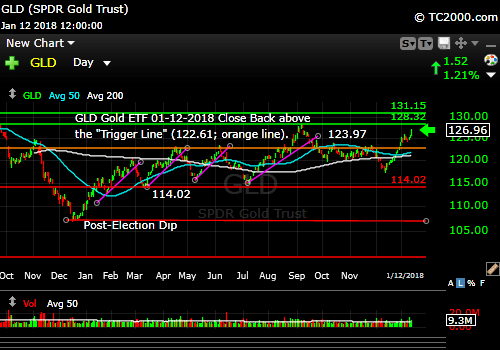

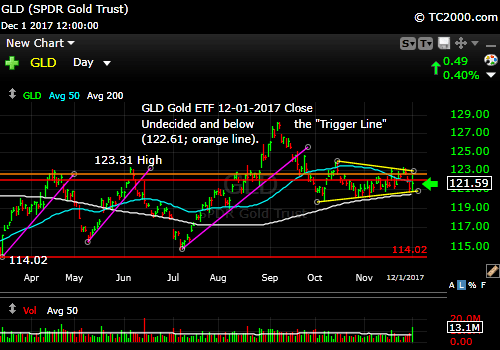

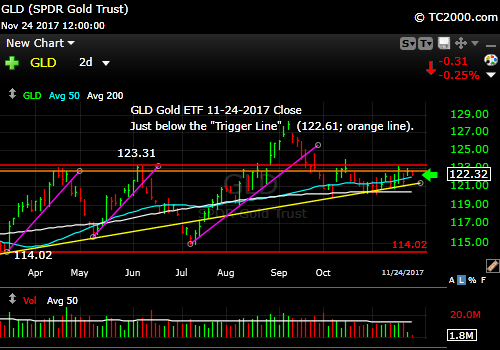

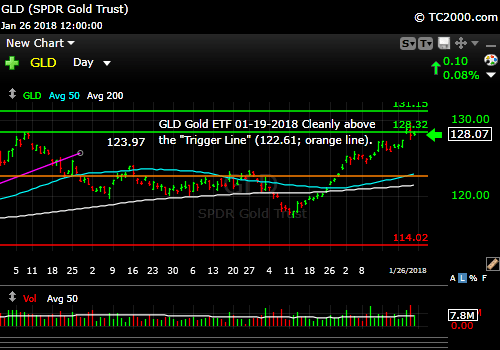

3. Gold Market Timing: Gold is now testing the 2017 high. The U.S. Dollar trend was your friend in gold this week as the administration tried to back out of comments made by Sec. Mnuchin about the joy of having a weak dollar in the short term (see my social media comments). Watch the dollar this week and protect gold profits in trading positions. TrumpFlation is here and may sustain the rise in interest rates. See the next section on that.

Gold ETF (click chart to enlarge the chart; GLD): (CORRECT DATE IS 1-26-2018 Close)

Testing 2017 high. Follow the dollar!

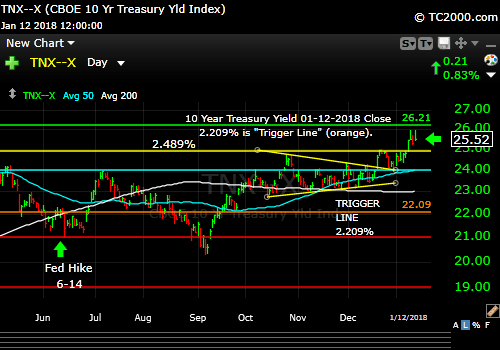

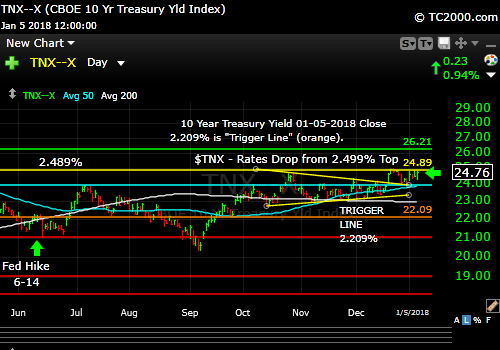

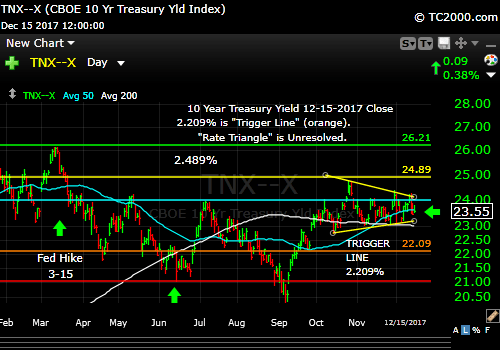

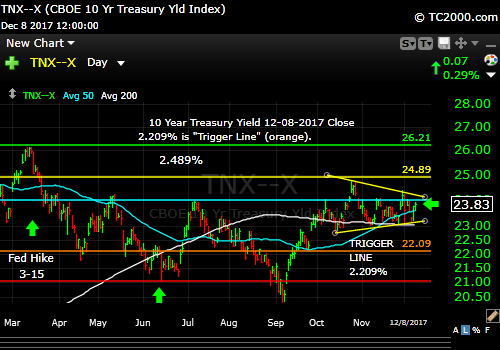

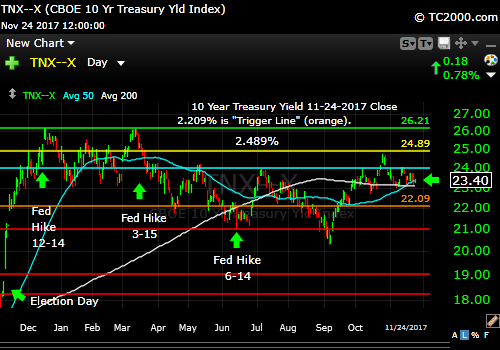

4. Interest Rate Market Timing – U.S. 10 Year Treasury Note Yield (TNX): The 10 Year Yield is currently levitating above the green line shown in the market timing chart below. It must hold that level and then rally or financials (and perhaps the entire market) will correct at least a bit. If it breaks out again to the upside, we’ll know the TrumpFlation thesis is still intact.

U.S. 10 Year Treasury Note Yield (click chart to enlarge; TNX, IEF, TYX,TLT,TBF):

Must continue rising to support further financial stock gains and perhaps SPY/SPX gains.

We need to review our three market timing signals (below the Bitcoin comments)…

5. Bitcoin Market Timing: A quick note. Bitcoin has been holding above the support I outlined last week. I hope you’ve adjusted your position size to remain a Bitcoin millionaire if you became one during the rise of Bitcoin. I brought this up on January 7th just after a big bounce in Bitcoin. If you haven’t, you really don’t know what you are doing.

If you “have” wealth, you know the rules. If you “want” wealth, you don’t have any rules and you eventually lose most of, too much of, or all of what you have gained, whether in bitcoin or in risky stocks. Even Berkshire Hathaway has fallen 50% multiple times from pricey market tops. “Having wealth” doesn’t mean you need to be a millionaire yet, but you are on your way if that is the state of your consciousness, or “mind” if you prefer. Even “safe stocks” like GE can become risky. Or remember Enron? WorldCom? Follow the guidelines of investing that are meant to prevent greed and large losses, or be prepared for huge disappointments ahead. Learn about position sizing and trailing stop losses and use them. They can protect any investor from huge market declines.

Now let’s review the three market timing signals together….

MY SIGNAL SUMMARY for a Further U.S. Stock Market Rally with Low Inflation:

Stock Signal GREEN

Staying long for now.

Note: I’ve changed my criteria for the equity signal for a further U.S. stock market rally to the following: Green = Bullish, Yellow = Neutral, Red = Bearish. Note that a Bearish signal does not mean we should not buy. It depends on what is going on in the economy and how oversold the market is at a given point whether the Bearish signal is to be sold, sold on the next bounce, etc. I will keep showing the prior orange “Trigger lines” in the charts for now as reference points only.

Gold Signal RED

GLD is ABOVE the “Trigger line” which is positive for gold, and usually worse for stocks at least on a relative basis, IF inflation is getting out of hand. Then it’s gold up (based on negative real rates of return on debt), stocks down (again, eventually that is, if inflation becomes too “hot”). Lately, it’s been dollar down, gold up, and stocks up. The dollar is playing a role against the backdrop of rising rates. Down dollar with rising rates and falling bonds, means investors are losing in longer term debt. Gold looks great compared to that.

Rate Signal GREEN

10 Year Yield ABOVE the “Trigger Line,” good for stocks, not bonds.

Thank you for reading. Would you please leave your comments below where it says “Leave a Reply”… or ask a question… Pay it forward too by sending the link to MarketTiming.Blog (that link will immediately connect them to this webpage) to a relative or friend. Thanks for doing that.

Be sure to visit the website for more general investing knowledge at:

Sun and Storm Investing™

Standard Disclaimer: It’s your money and your decision as to how to invest it.

I thank Worden Brothers for the charting system I use to post these charts. If you want to know more about the charting system I use every day, go to my “Other Resources” page here: Other Resources It makes it much easier to follow along with me if you can see the charts and manipulate them on your own computer. It’s a great investment to have an excellent charting system. Check it out with a free trial at the link above.

Copyright © 2018 By Wall Street Sun and Storm Report, LLC All rights reserved.

Share this with Facebook, Twitter or by Email: